Fake Check Scams - How To Avoid This Exploding Epidemic

Authored By: Genisys Credit Union on 10/24/2018

Has someone ever sent you a check and asked you to give them some money back? Be wary! Maybe you won a prize and are told to send back a portion to cover taxes and fees. Or you get paid to be a “secret Shopper” and are told to wire back money. How about selling an item online and the buyer overpays? In all cases, you get a check and someone asks you to send them money back. That’s a scam!

Recently, the Better Business Bureau (BBB) released a report warning about a spike in fake check scams. These scams now reach 500,000 victims each year.

The largest group of targeted victims are the 20 somethings because scammers know that this group is not regular users of checks. They tend to opt for electronic payment options like PayPal or Square more frequently than paper checks, so often they don’t understand the issues with this scam.

Aside from ordinary personal checks, this scam can also be pulled off with cashier’s checks and money orders. As with many past scams, these involve a scammer “overpaying” a victim. The scammer then requests that the check be cashed with the “overpayment” being deposited into a designated account belonging to the scammer.

Here are the most common variations of the scam:

-

“Buyers” send sellers a check written out for more than the asking price of an object sold on an online marketplace.

-

Lottery “winners” are rewarded with an inflated prize with instructions to pay back a part of the check to cover taxes or fees.

-

“Employees” are granted checks for supplies with instructions to wire back a part of it to the “company.”

-

Mystery Shopper scams where you are sent a check to shop and rate the experience and a portion of the check is your fee.

Here’s an example of how the Mystery Shopper scam works.

A woman from Dallas Texas told NBC News about her scam experience. She got an email from a mystery shopping company asking her to do work for them. The email seemed very legit and she even checked their website and thought everything was on the up and up. Her assignment was to rate money transfer companies. The scammers sent her a check for $2,850 and emailed her a list of questions to fill out about her experiences. The check she received was a cashiers check and looked totally legit to her. She was told to deposit the check into her bank account, take the cash and go to three different money transfer services and wire $900 from each. That left her with $150 for doing the job.

About a week later she was contacted by her bank telling her that the check was counterfeit and could not be cashed, so the money she withdrew would be taken from her checking account. She was out the $2,700 that she used for the 3 wire transfers. Guess where that money went? Wired to the scammers that sent her that check!

Wondering if a check is a fake? Here are some items to look for.

-

Is the check paper stock weak and flimsy?

Any legitimate check will be printed on paper that resembles letterhead thickness.

-

Check the company’s name and address. Are they spelled correctly?

Commonly, most scams will have misspellings or grammatical errors.

-

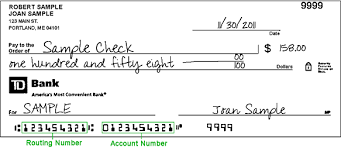

Verify that the check’s identification numbers printed at the top and the bottom match up. The check number will be in the upper right side of the check as well as in the bottom line of numbers.

-

If you’re allegedly holding a lottery winning check in your hands, it should be written out by a state lottery commission. Was this lottery something that you entered? People aren’t generally lottery winners without playing the actual lottery, right?

-

Look for the special ink required for the Magnetic Ink Character Recognition (MICR) code at the bottom of the check. It has a different feel from the rest of the ink printed on the check.

-

The check should have a routing number on it. You can Google the bank that the check is drawn off of to find out if the routing number is genuine. The routing number is the first series of numbers (9 digits) printed in the MICR line at the bottom of the check. The next series of numbers are the account number.

It’s also important to know which kinds of transactions are likely to be scams. If you come across any of the following scenarios below, beware and don’t think that free money just dropped in your lap.

-

You’re asked to wire money to a company or person you’re not familiar with

-

You receive a check for an online marketplace sale that is more than the sale price

-

You’re sent a check from a foreign bank you’ve never heard of

-

You’re asked to pay a fee to claim a prize you’ve won; sometimes in a sweepstakes you did not enter

Our credit union staff is trained to identify bad checks. You can always bring in a check you are uncertain of and we can take a look and let you know what we think. And if you think you are being scammed, do not deposit the check, and be sure to contact the Federal Trade Commission at ftc.gov/complaint.

SOURCES:

http://www.semissourian.com/story/2549480.html

https://www.news-leader.com/story/news/local/ozarks/2018/09/05/better-business-bureau-releases-report-fake-check-scams/1202964002/

https://www.google.com/amp/s/www.cbsnews.com/amp/news/fake-check-scams-an-exploding-epidemic-new-report-says-better-business-bureau/

https://www.nbcnews.com/business/consumer/fraud-alert-fake-checks-used-variety-costly-scams-n790211

© Genisys Credit Union and www.genisyscu.org, 2018. Unauthorized use and/or duplication of this material without express and written permission from this site’s author and/or owner is strictly prohibited. Excerpts and links may be used, provided that full and clear credit is given to Genisys Credit Union and www.genisyscu.org with appropriate and specific direction to the original content.

« Return to "Blog"